As many of you would have read in my previous articles, I have a great passion for transforming finance teams to make them more efficient and effective, and elevating them to a strategic level within their organisation. Equally I have a passion for the wellbeing of the finance professional. It will probably come as no surprise to many of you that I think that the two subjects are inextricably linked.

This article sets out why this is the case and how finance transformation can lead to a win-win situation for all and how the wellbeing of the finance professional should not be overlooked.

The changing role of the finance team

This is a much discussed topic and there is little need for me to go into the details of why the role of the finance team is changing. However, it is worth digging into the impact that this has on the finance professional by looking at their workload in a typical period cycle.

The tasks of the finance team can be split between what I call ‘Core’ or ‘Strategic’.

Core – this is split into two;

- day to day accounting processes – accounts receivable and payable, cash management and other general ledger responsibilities

- periodic activities – reconciliation, management reporting, budgeting and forecasting, statutory reporting

Strategic is, as the title suggests, those activities that add value to the organisation. Again, this is much discussed and is about being at the top table, supporting and leading the business for decision making.

Our theoretical example is based on a typical group finance role in a large organisation, although it could just as easily relate to any finance role in any organisation.

Period cycle before transformation

The finance team in question has yet to transform and embrace technology as an enabler. Their processes are highly manually intensive.

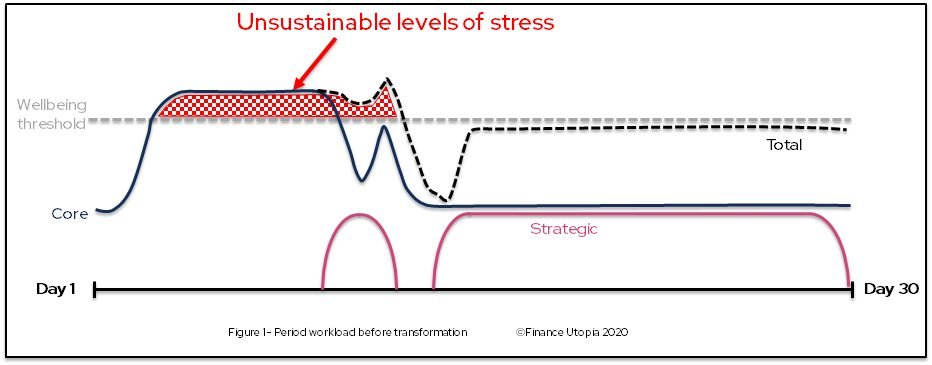

The diagram below illustrates the workload on a finance team member over a typical period.

This shows the Core workload increasing soon into the period end with the close of the underlying accounting systems and the activities associated with this. The workload continues at a high level during consolidation and the potential re-forecasting process (or at least a revised outlook). The only Strategic activity is narrative being added to the data to explain the analysed variances, turning data into information (if time exists for this at all). The period end reporting concludes with the assembly of the report pack and distribution to consumers, the so called last mile of finance. At this point Core workload returns to a base day-to-day level. During this ‘quiet’ time, other projects and assignments can be tackled, although this still leaves the finance professional working at near maximum capacity. This does not of course include the potential quarterly and annual commitments such as the budget cycle.

As you can see, for a significant portion of the period, the finance professional is working above what we term the ‘wellbeing threshold’.

Period cycle after transformation

The finance team has undergone a transformation. They have automated Core processes such as:

- data reconciliations and intercompany matching

- financial consolidation and reporting

- report assembly

They have also implemented a tool for analysing data and an enterprise planning solution allowing them to move to rolling forecasts (or continuous planning as it is sometimes called).

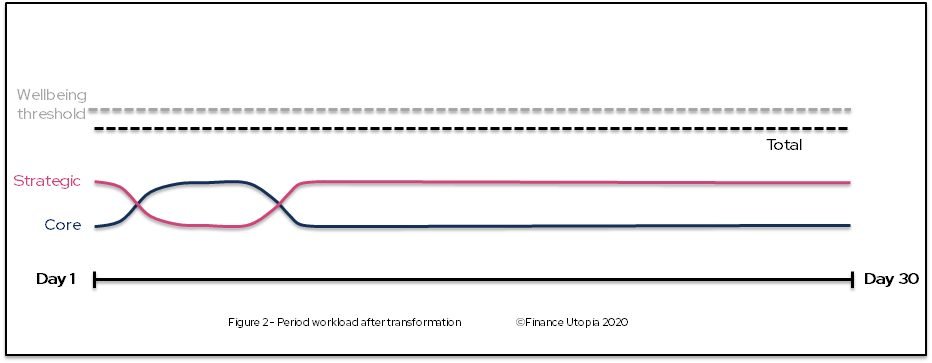

The impact of this on the workload of a finance team member is illustrated in the diagram below.

As you may expect, the base level of the day-to-day Core activity is lower as many processes are now automated. It does increase slightly over the period end cycle, nowhere near to the extent of the pre-transformation position. A factor in this is transforming the previously period end activities of reconciliation and intercompany matching to ongoing processes as the period progresses.

What this means is that Strategic activity can continue throughout the period and it becomes the role that consumes most of the workload. The total workload on the finance professional remains below the ‘wellbeing threshold’ throughout. In addition, as a result of the adoption of rolling forecasts, there are fewer activities that cause workload spikes on a quarterly and annual basis.

The benefits of transformation

Yes, this is just a hypothetical situation. However, all the evidence we have and the discussions with finance professionals and organisations backs up our illustrative example. A successful finance transformation will provide many benefits to an organisation and these have been much discussed in numerous books and papers and by various analysts and contributors. I think that this is accepted by most.

What rarely gets discussed though is the resulting impact of a successful transformation on the wellbeing of your biggest asset, the finance professional. There are two aspects to this:

- Sustainable workload – the ‘wellbeing threshold’ is not an exact science, nor is it meant to be. It is not just about the hours; it also needs to include other factors such as the level of stress associated with the work being performed.

- Personal development – If you ask a finance professional whether they prefer to perform Core or Strategic processes, most would opt for the latter. This allows them to showcase their skills and experience that they have gained which provides them with a path for development within an organisation.

What we do know is that finance professionals will suffer if they continue to work under unsustainable levels of stress for a period of time. Also, it would seem that the more strategic the workload, the happier the finance professional is. A successful finance transformation can address both of these issues.

In Conclusion

We often evaluate finance transformation in respect of the benefits that an organisation can derive from it. This is still valid and there are many. However, what many organisations overlook, or at least only see as a by-product, is the positive impact and benefits on the wellbeing of their biggest asset, the finance professional. They are doing the Strategic work that they have always aspired to and their workload is sustainable allowing them to lead a ‘normal’ life. They are more likely to stay at your organisation and help you to attract new top finance talent in the future (see my recent article – attracting top finance talent).

So, a win-win for the organisation and the finance professional. Why wouldn’t you want to start a finance transformation journey?

Leave A Reply