First published on LinkedIn, click here to see it and comments added by others.

There was a really informative independent publication circulated by the Sunday Times on 3rd November 2019 from Raconteur.net entitled “The Future CFO” – it can be accessed on line here. Articles included the inevitable discussions and views on Digital Transformation, AI and Machine Learning. What took my eye though was a thought provoking article on “Fighting CFO burnout” by Azadeh Williams.

As finance professionals know, the heat is really on the CFO at the moment. So many factors are piling the pressure on and this only seems to be increasing week-on-week. The uncertainty caused by Brexit, accelerating technology changes, the need to cut costs. No wonder so many CFOs are stressed and approaching burnout.

The article referred to gives examples of CFOs who have experienced stress and burnout and the impact this has had on them. As you would expect, there is no silver bullet that takes stress away but there are ways of managing the situation.

Beyond the CFO

Whilst this article concentrates on the CFO, what we also need to consider is the impact that a stressed CFO has on the other members of the Finance Team. It is almost inevitable that any stress being experienced by the CFO will be transferred to the Finance Team as a whole, not just the direct reports. Ultimately, the CFO relies upon the team to provide him with the information he needs to guide the CEO and the organisation.

What we have experienced in the past is the scenario where we are contacted by a senior member of the Finance Team who is working at the coal face and is frustrated (and stressed) by their job. This often has the following symptoms:

- They do not feel valued – whilst they are highly qualified, they are stuck performing low level manual tasks and unable to show their full potential

- Long hours – theyare continually working long hours with large activity spikes at period end,quarter end and year end

The second issue, that of long hours, is expected in the finance community whether you are a CFO or a Group Financial Controller. However, whilst it goes with the territory, working long hours due to inefficiencies of process or technology is neither clever nor justified. This is the bit that sometimes goes underneath the radar of a busy CFO, especially if they are less approachable to staff due to stress.

The first symptom, feeling undervalued, is equally as frustrating. The CFO is in a position to ensure that, as an individual within that role, that they are valued. In this respect, the relationship with the CEO is critical, something highlighted within the article. However, it is also critical that the Finance Team in its entirety is similarly perceived within the organisation i.e. seen as a valued business partner. There is a survey referenced within the article (Korn Ferry – CFO Pulse Survey 2018) shown below:

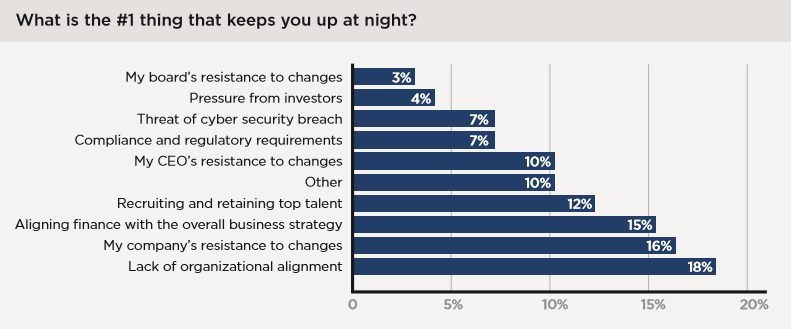

This shows that 18% of CFOs surveyed saw a ‘lack of organisational alignment’ as the “Number one thing that keeps CFOs up at night” and 15% as ‘aligning finance with the overall business strategy. Both of these appear to back up the issue of how the Finance Team is perceived.

Relieving the Stress – get the basics right

Quite interestingly, nowhere in the survey does it mention advanced technology (AI or Machine Learning). We know that it was a 2018 survey but we think this is significant as this is not what keeps the CFOs we know awake at night.

In our experience of working with Finance Teams across multiple industry sectors, many organisations are still struggling to deliver the ‘basic’ processes efficiently and effectively. By ‘basic’ we mean the six core processes;

- Transaction recording

- ERP Close

- Group Close (Consolidation)

- Report & Analyse

- Budget, Plan & Forecast

- D

The first, transaction recording, is potentially the most long term to solve as it often requires a new ERP solution or a re-implementation. Quick wins can be achieved in the other five processes, from ‘Close to Disclose’. This is often where the talent within finance sits, those paid for their qualifications and capability to add insight and value. When they are stifled by a lack of time or lack of tools, this is where the frustration sets in and attrition rates increase.

Again, going back to the article and the survey, ‘resistance to changes’ by the company, the CEO and the board adds up to a staggering 29%. This goes a long way to explaining why many organisations still have old legacy systems with inefficient processes. A consequence, CFOs are fearful of ‘retaining top talent’ who will naturally migrate to organisations where they are valued and can develop and show their capability and reach their full potential.

The need to transform

This brings us back to the wellbeing of the CFO and the Finance Team. If the stress levels are to be managed and burn out avoided, then many Finance Teams need to transform – it is no longer an option. This transformation can be broken down into three key steps that the CFO needs to take:

- sell the vision for the need to change to the CEO, the board and the company as a whole

- as a key stakeholder, overseeing and selecting the right technology platform

- ey stakeholder, ensuring transformation is delivered

Whilst this will not ensure you recruit and retain top talent, it will certainly help build your ‘employee brand’. More importantly, the wellbeing of the CFO and the Finance Team can be significantly improved. Perhaps then the CFO will have a sleepless night worrying about AI and Machine Learning!

Leave A Reply